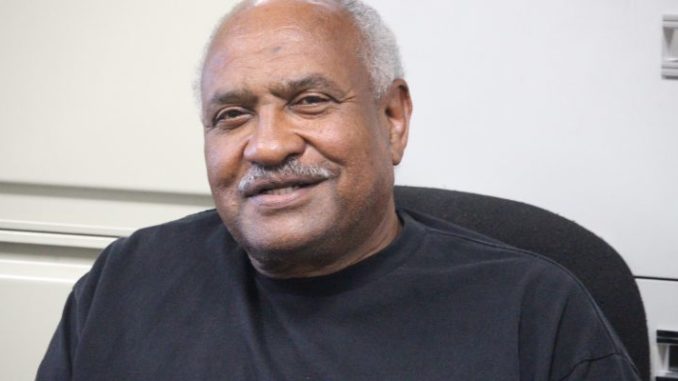

By Dr. John E. Warren, Publisher

The Wells Fargo scandal is far from over and it continues to provide insight into the “Cherry Picking” culture of providing select help in places where it seeks to get the greatest impact. In New York City, there was an investment of over $10 billion dollars in affordable housing construction. But that alone appears not to be enough to keep the City from following its own rules when considering where to bank. Perhaps other customers of Wells Fargo should take a close look at these facts.

In March of this year, federal regulators, using the Community Reinvestment Act (CRA) changed the banks rating from “satisfactory” to “needs improvement”, citing an extensive pattern of discriminatory and illegal lending practices. Under New York City rules, in order to get government deposits, a bank must have at least a “satisfactory” rating with the Comptroller of the Currency following the CRA. The City of New York reportedly has hundreds of millions of dollars deposited with Wells Fargo bank. The city’s Banking Commission meets May 31st and could vote to move those funds based on its own rules. Meanwhile, a spokesperson for the city says that they have recommended a number of steps for the bank to “began restoring investor, customer and public confidence”.

Clearly if other cities and individuals, customers and investors followed the Community Reinvestment Act policy of the federal regulators, there would be more people taking a closer look at doing business with Wells Fargo Bank.

Earlier this month, lawyers in San Francisco, representing customers who are suing Wells Fargo, stated that the bank opened 3.5 million unauthorized accounts over the past 15 years, instead of the 2 million unauthorized accounts previously reported, “Based on public information, negotiations, and confirmatory discovery.” This information was based in part on the fact that federal regulators, when looking at the scandal, only went back as far as 2009. Last month the bank said the problem dates back to 2002.

Where the bank had initially agreed to pay $110 million dollars in settlements going back to 2009, it has now agreed to add an additional $32 million dollars to include claims starting in May of 2002. These dollars are in addition to the $185 million fine Wells Fargo agreed to in September 2016. The September fine is to be paid to the federal Consumer Financial Protection Bureau and the federal Office of the Comptroller of the Currency and the Los Angeles city attorney. Following this announcement, shares of Wells Fargo fell 1.3 percent. So far in 2017 Wells Fargo shares have dropped 3.8 percent.

It appears that Wells Fargo is willing to pay everyone except the African American community and it appears that the use of our newspapers to reach a wounded, underserved and omitted customer base with which the bank is seeking to “Restore Customer Confidence” continues to include all newspapers and media outlets except the African American community. The bank has decided to serve the Black customer base through “Cherry Picking” those among us it deems important while omitting others who still do business with Wells Fargo Bank. The Community Reinvestment Act as a matter of public policy requires outreach to all communities. The present conduct of Wells Fargo is exactly what led to the creation of the CRA in the first place.

The Wells Fargo scandal is far from over and it continues to provide insight into the “Cherry Picking” culture of providing select help in places where it seeks to get the greatest impact. In New York City, there was an investment of over $10 billion dollars in affordable housing construction. But that alone appears not to be enough to keep the City from following its own rules when considering where to bank. Perhaps other customers of Wells Fargo should take a close look at these facts.

In March of this year, federal regulators, using the Community Reinvestment Act (CRA) changed the banks rating from “satisfactory” to “needs improvement”, citing an extensive pattern of discriminatory and illegal lending practices. Under New York City rules, in order to get government deposits, a bank must have at least a “satisfactory” rating with the Comptroller of the Currency following the CRA. The City of New York reportedly has hundreds of millions of dollars deposited with Wells Fargo bank. The city’s Banking Commission meets May 31st and could vote to move those funds based on its own rules. Meanwhile, a spokesperson for the city says that they have recommended a number of steps for the bank to “began restoring investor, customer and public confidence”.

Clearly if other cities and individuals, customers and investors followed the Community Reinvestment Act policy of the federal regulators, there would be more people taking a closer look at doing business with Wells Fargo Bank.

Earlier this month, lawyers in San Francisco, representing customers who are suing Wells Fargo, stated that the bank opened 3.5 million unauthorized accounts over the past 15 years, instead of the 2 million unauthorized accounts previously reported, “Based on public information, negotiations, and confirmatory discovery.” This information was based in part on the fact that federal regulators, when looking at the scandal, only went back as far as 2009. Last month the bank said the problem dates back to 2002.

Where the bank had initially agreed to pay $110 million dollars in settlements going back to 2009, it has now agreed to add an additional $32 million dollars to include claims starting in May of 2002. These dollars are in addition to the $185 million fine Wells Fargo agreed to in September 2016. The September fine is to be paid to the federal Consumer Financial Protection Bureau and the federal Office of the Comptroller of the Currency and the Los Angeles city attorney. Following this announcement, shares of Wells Fargo fell 1.3 percent. So far in 2017 Wells Fargo shares have dropped 3.8 percent.

It appears that Wells Fargo is willing to pay everyone except the African American community and it appears that the use of our newspapers to reach a wounded, underserved and omitted customer base with which the bank is seeking to “Restore Customer Confidence” continues to include all newspapers and media outlets except the African American community. The bank has decided to serve the Black customer base through “Cherry Picking” those among us it deems important while omitting others who still do business with Wells Fargo Bank. The Community Reinvestment Act as a matter of public policy requires outreach to all communities. The present conduct of Wells Fargo is exactly what led to the creation of the CRA in the first place.

Be the first to comment