/ NNPA NEWSWIRE — (Source: www.blackpressusa.com) By Stacy M. Brown, NNPA Newswire Senior National Correspondent “President Biden believes that a post-high school education should be a ticket to a middle-class life, but for too many, the cost of borrowing for college is a lifelong burden that deprives them of that opportunity,” administration officials said ahead of Biden’s scheduled announcement.

The Department of Education reported that the typical undergraduate student with loans graduates with nearly $25,000 in debts.

Some Borrowers to Receive Total Forgiveness

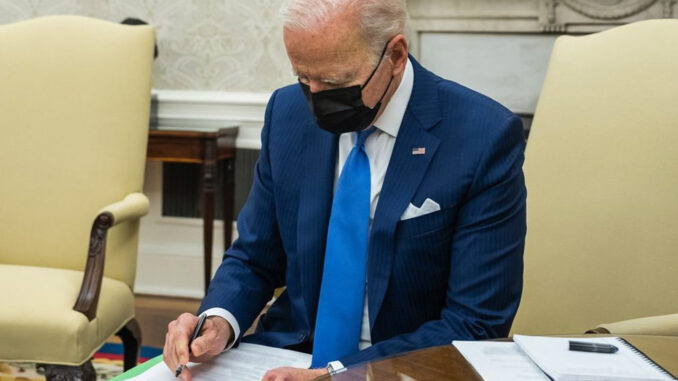

President Joe Biden on Wednesday introduced a three-part plan the administration said delivers on his promise to cancel $10,000 of student debt for low-to-middle-income borrowers.

After much speculation on what Biden would do, the White House announced that the administration would provide up to $20,000 in debt cancellation to Pell Grant recipients, and up to $10,000 to non-Pell Grant recipients.

The president also extended the current federal loan pause through December.

“During the campaign, he promised to provide student debt relief. Today, the Biden Administration is following through on that promise and providing families breathing room as they prepare to start re-paying loans after the economic crisis brought on by the pandemic.”

Administration officials said the Biden-Harris administration had already provided more than $32 billion in loan relief to 1.6 million borrowers.

The president insists that the actions would help borrowers who need relief the most.

The administration said nearly 90% of relief dollars are going to borrowers earning less than $75,000 annually.

“The student debt burden also falls disproportionately on Black borrowers,” officials asserted.

“Twenty years after first enrolling in school, the typical Black borrower who started college in the 1995-96 school year still owed 95% of their original student debt.”

“Even before applying the additional $10,000 for recipients of Pell Grants, the typical Black borrower will see their balance cut nearly in half, and more than one in four Black borrowers will see their balance forgiven altogether,” administration officials stated.

In a Fact Sheet, the White House noted that since 1980, the total cost of both four-year public and four-year private college had nearly tripled, even after accounting for inflation.

Federal support hasn’t kept up, administration officials stressed.

Pell Grants once covered as much as 80 percent of the cost of a four-year public college degree for students from working families.

Now, those grants cover only one-third of the cost.

The Department of Education reported that the typical undergraduate student with loans graduates with nearly $25,000 in debts.

“The skyrocketing cumulative federal student loan debt – $1.6 trillion and rising for more than 45 million borrowers – is a significant burden on America’s middle class,” officials insisted.

Middle-class borrowers struggle with high monthly payments and ballooning balances that make it harder for them to build wealth, like buying homes, retirement savings, and starting small businesses.

“For the most vulnerable borrowers, the effects of debt are even more crushing,” officials stated.

Nearly one-third of borrowers have debt but no degree, according to an analysis by the Department of Education of a recent cohort of undergraduates.

Many of these students could not complete their degree because the cost of attendance was too high, the analysis found.

About 16% of borrowers are in default – including nearly a third of senior citizens with student debt – which can result in the government garnishing a borrower’s wages or lowering a borrower’s credit score.

Be the first to comment